income tax calculator indonesia

Annual Tax Exempt Income This field is adjusted toward your status Eg. If you are S-0 for the tax year 2014 your tax exempt income becomes Rp 24300000 dan if you are M-2 in the.

Personal Income Tax In Indonesia For Expatriate Workers Explained

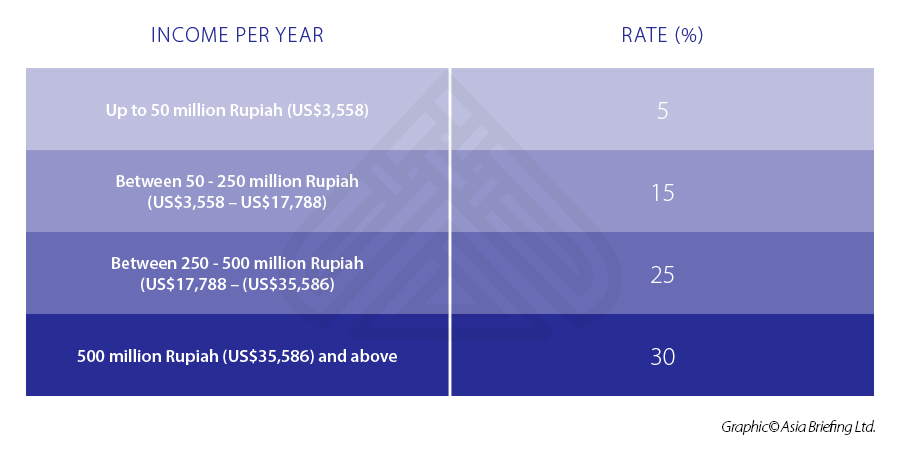

In the section we publish all 2022 tax rates and thresholds used within the 2022 Indonesia Salary Calculator.

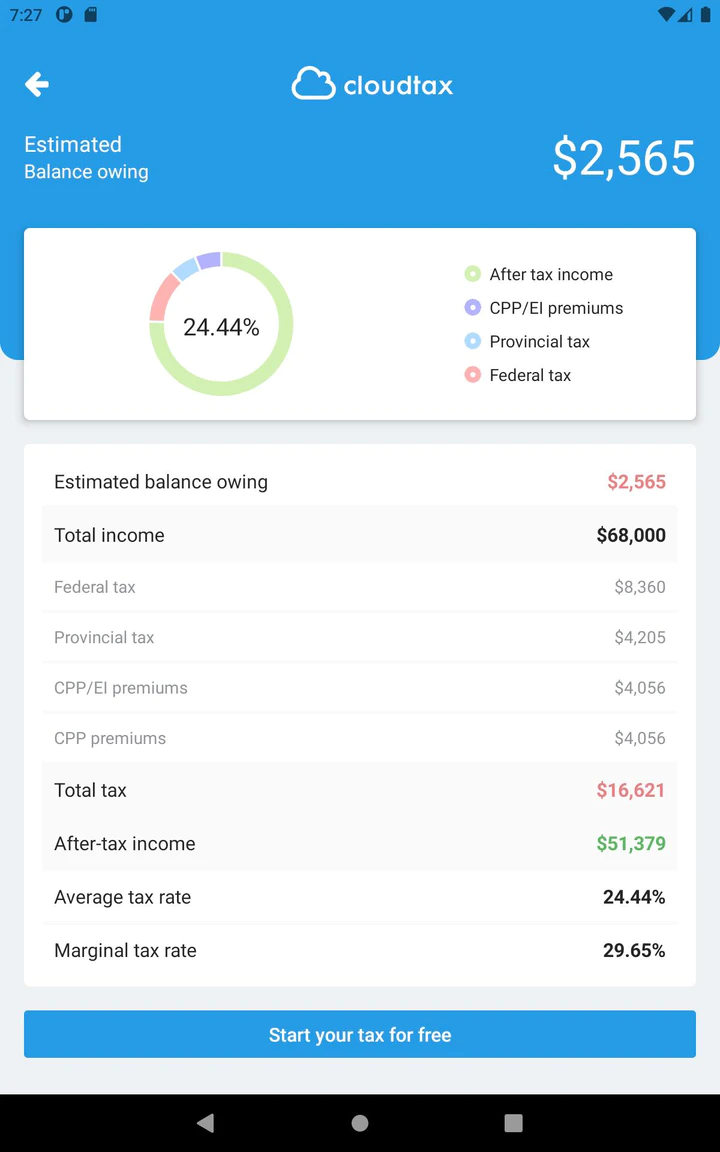

. Indonesia Annual Salary After Tax Calculator 2022. The Annual Wage Calculator is updated with the latest income tax rates in Indonesia for 2021 and is a great calculator for working out your. The Monthly Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working.

Total value in IDR Import Duty x 10. Corporate Income Tax Rate. Example of a standard personal income tax calculation in Indonesia Worldwide Tax Summaries.

All companies doing business in Indonesia both locally owned and foreign owned are required to fulfill the corporate income tax obligations. Import Duty BM. This means that if you are aware of a 2022 tax exemption or 2022 tax.

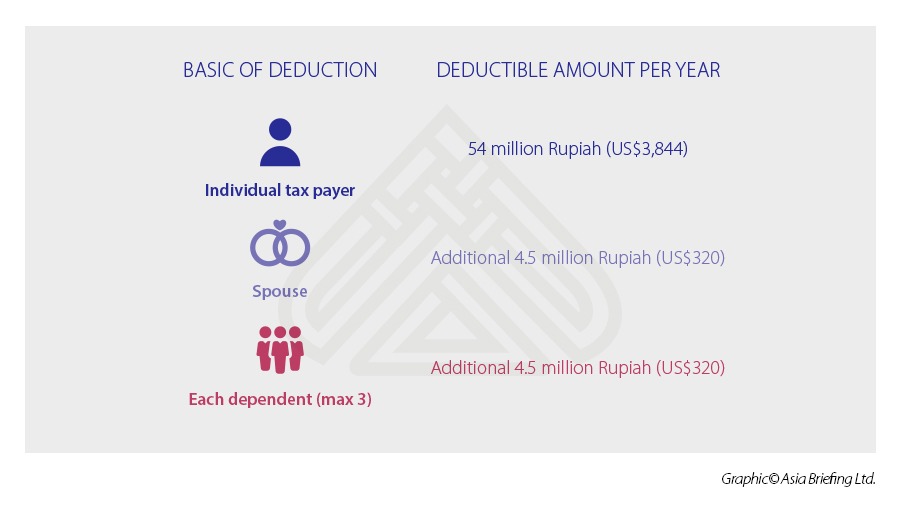

Total value in IDR x percentage of import duty. Deductions for an individual are Rp 2880000 wife 2880000 and up to three children Rp 1440000. Position Expense Biaya Jabatan is a deduction with a maximum 5.

Total value in IDR Import Duty. Estimate your tax refund with HR Blocks free income tax calculator. Indonesia Monthly Salary After Tax Calculator 2022.

Total value x percentage of import duty. Estimate your tax refund or how much you may owe to the IRS with TaxCaster our free tax calculator that stays up to date on the latest tax laws so you can be confident in the. Total value Import Duty x 10.

Indonesia Daily Salary After Tax Calculator 2022. Income Tax PPh. As for other taxpayers with NPWP National Taxpayer Identification Number in the country the amount of their taxable annual income decides their personal income tax.

Calculate your income tax in Indonesia salary deductions in Indonesia and compare salary after tax for income earned in Indonesia in the 2022 tax. Corporate income tax CIT rates. Total value Import Duty x.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Indonesia Salary Calculator 2022. The Daily Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working out.

The Annual Wage Calculator is updated with the latest income tax rates in Indonesia for 2022 and is a great calculator for working.

Far East Tax Calculators And Salary Calculators By Icalculat

Business Tax Deadline In 2022 For Small Businesses

Indonesia Levies 0 1 Vat Income Tax On Crypto

Corporate Income Tax Software Thomson Reuters Onesource

Singapore Income Tax Calculator Corporateguide Singapore

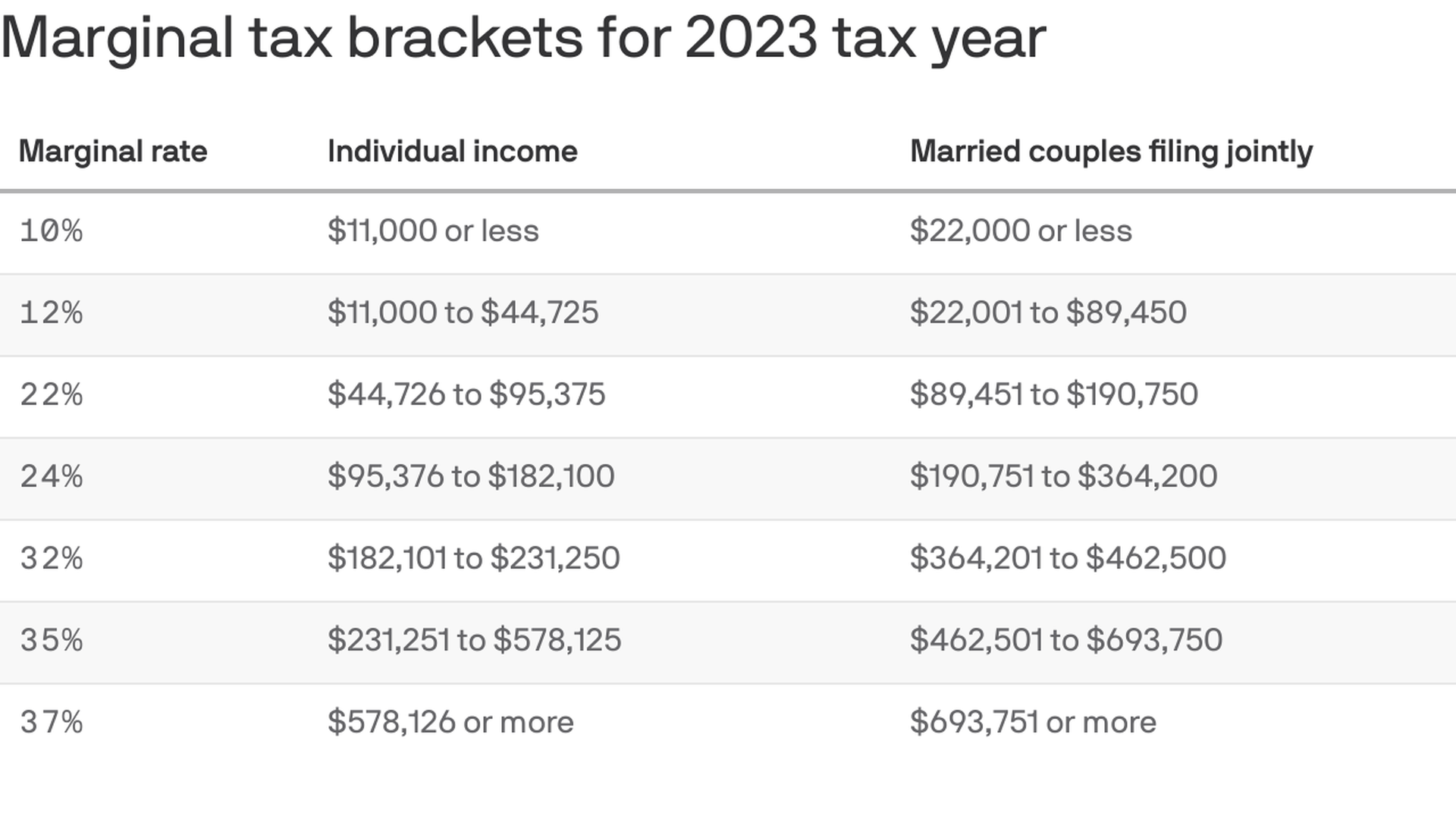

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

Could A Data Tax Replace The Corporate Income Tax

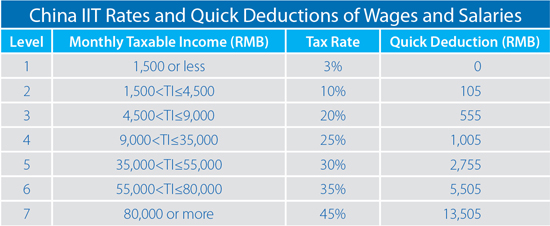

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

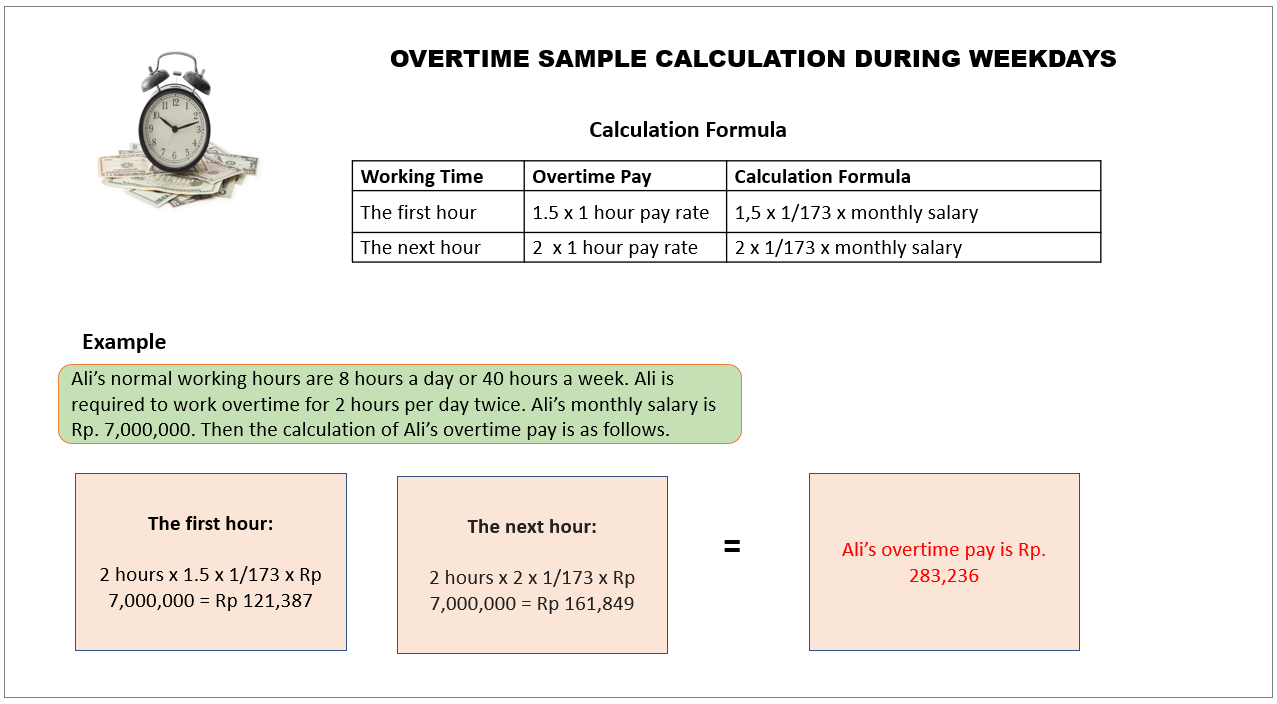

Indonesia Payroll And Tax Guide

Personal Income Tax In Indonesia For Expatriate Workers Explained

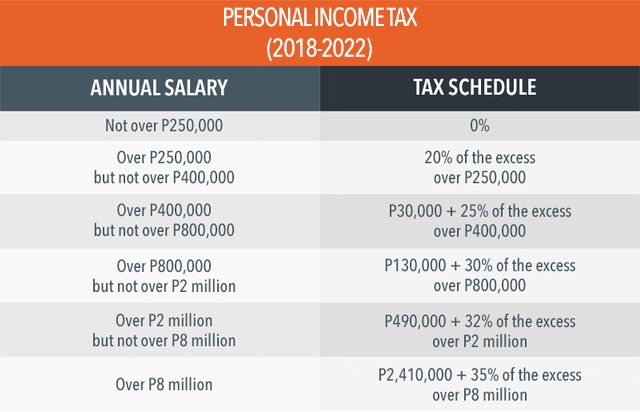

Tax Calculator Compute Your New Income Tax

Indonesia Introduces Three Business Friendly Tax Changes International Tax Review

4 Ways To Calculate Sales Tax Wikihow

Here Are The Federal Income Tax Brackets For 2023

Premium Photo German Annual Income Tax Return Declaration And Calculator Lies On Accountant Table Close Up The Concept Of Taxpaying Period In Germany

Income Tax Calculator Budget 2023 Pwc Ireland

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

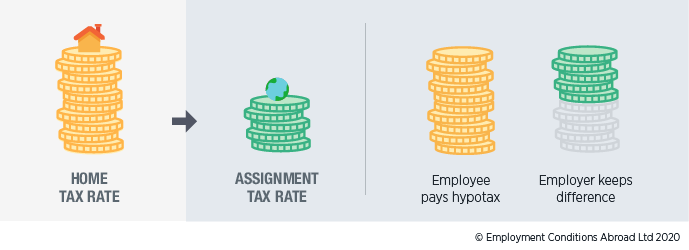

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International