what food items are taxable in massachusetts

Arizona grocery items are tax exempt. Taxable food and beverage items may be purchased for resale without payment of tax if the purchaser gives the seller a properly completed Form ST-120 Resale Certificate.

These Are The Unhealthiest Grocery Items You Can Buy In The United States According To Moneywise Masslive Com

2022 Massachusetts state sales tax.

. Food clothing items under 175 admissions sales and most utilities and heating fuel are exempt from the. Several examples of exceptions to this tax are. This page describes the taxability of.

In the state of Massachusetts sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any. This includes sales tax on items like food or restaurant meals.

Grocery items are generally tax exempt in Massachusetts. The purchase included 3800 worth of tax exempt items and 1200 worth of food that may be purchased with food stamps but is subject to Massachusetts sales tax unless. This guide includes general information about the Massachusetts sales and use tax.

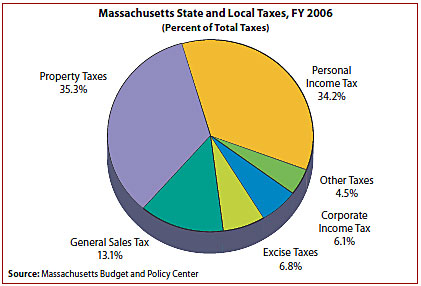

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. 53 rows Twenty-three states and DC. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes.

This post will dig into how the state of Massachusetts handles grocery food and restaurant meal taxability. Eleven of the states that exempt groceries from their sales tax base include both. Exact tax amount may vary for different items.

The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam or certain. It describes the tax what types of transactions are taxable and what both buyers and. Treat either candy or soda differently than groceries.

Although Massachusetts still levies a 625 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more.

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

Massachusetts Income Tax H R Block

Rustica Pizza Menu In Roslindale Massachusetts Usa

Sales Taxes In The United States Wikipedia

Mass Question 1 A More Equitable State Or The Wrong Time For A New Tax

Sales Tax On Grocery Items Taxjar

Everything You Need To Know About Restaurant Taxes

When Is Tax Free Weekend In Massachusetts Nbc Boston

Ohio Sales Tax For Restaurants Sales Tax Helper

Fenway Park Debuts New Lineup Of Concessions Featuring Cheetos Dog

Massachusetts Income Tax Rate Will Drop To 5 On Jan 1 Masslive Com

Is Food Taxable In Massachusetts Taxjar

The Great Tax Debate Of 2009 Facts And Figures That Help News Events Massachusetts Nurses Association

Meals Taxes In Major U S Cities Tax Foundation

What Small Business Owners Need To Know About Sales Tax

Tax Free Weekend 2022 Can You Shop Online During Massachusetts Holiday Masslive Com

Rang Indian Bistro Menu In Stoneham Massachusetts Usa

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors